A Comprehensive Guide on How to Find Student Loan Account Number for IRS Tax Purposes

Guide or Summary:Understanding the Importance of Your Student Loan Account NumberSteps to Locate Your Student Loan Account NumberWhy You Need Your Student L……

Guide or Summary:

- Understanding the Importance of Your Student Loan Account Number

- Steps to Locate Your Student Loan Account Number

- Why You Need Your Student Loan Account Number for IRS Filing

#### Translation: how to find student loan account number for irs

Understanding the Importance of Your Student Loan Account Number

When it comes to filing your taxes, knowing how to find your student loan account number for IRS purposes is crucial. This number is essential for accurately reporting your student loan interest deduction and ensuring that all your financial information is correctly documented. The IRS requires this information to verify your claims and to process your tax returns without any hitches.

Steps to Locate Your Student Loan Account Number

Finding your student loan account number may seem daunting, but it can be simplified by following a few straightforward steps:

1. **Check Your Loan Documents**: The first place to look for your student loan account number is in your loan agreement or any official correspondence from your lender. These documents usually contain your account number prominently displayed.

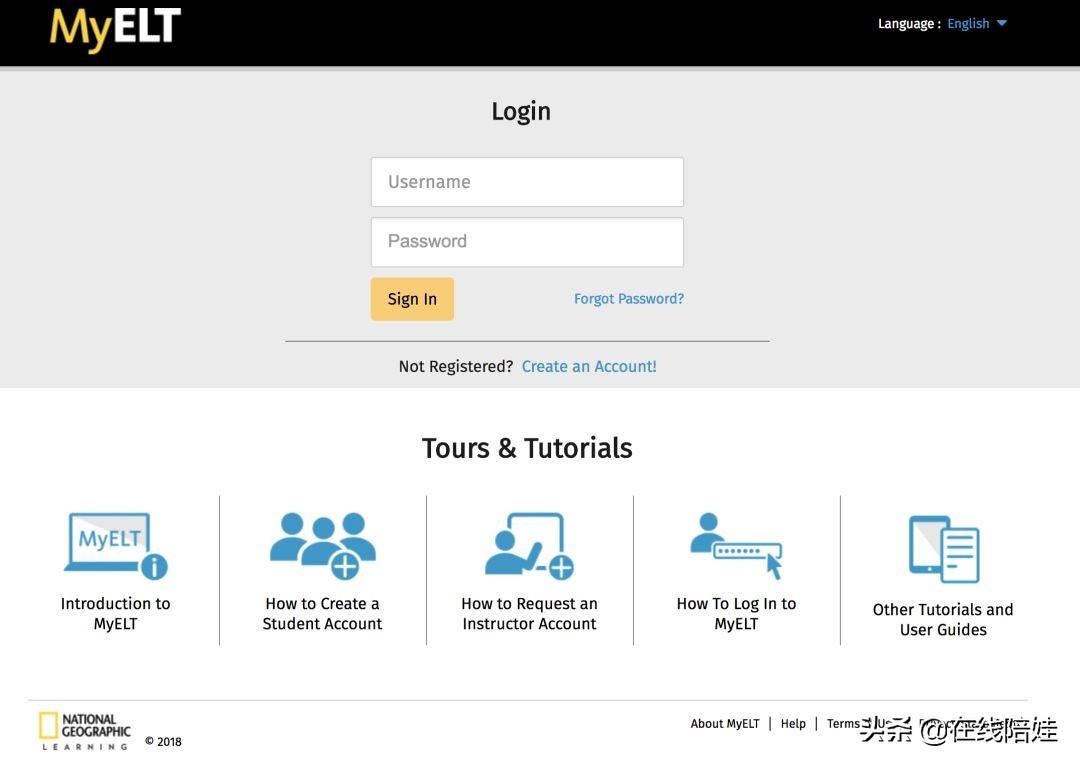

2. **Log into Your Loan Servicer’s Website**: Most student loans are managed by a loan servicer. By logging into your account on their website, you can easily access your account details, including your account number. If you haven’t set up an online account yet, you may need to create one using your personal information.

3. **Contact Your Loan Servicer**: If you’re unable to find your account number online or in your documents, consider reaching out directly to your loan servicer’s customer service. They can assist you in retrieving your account number after verifying your identity.

4. **Review Your Credit Report**: Your student loans are reported to credit bureaus, and you can find your account number listed on your credit report. You are entitled to one free credit report per year from each of the major credit bureaus, which can be accessed through AnnualCreditReport.com.

5. **Check Your Tax Returns from Previous Years**: If you’ve claimed student loan interest deductions in the past, your account number may be listed on those tax returns. Reviewing previous filings can provide you with the information you need.

Why You Need Your Student Loan Account Number for IRS Filing

The IRS allows taxpayers to deduct the interest paid on qualified student loans, which can significantly reduce your taxable income. To claim this deduction, you need to provide your student loan account number. Failing to include this information can lead to delays in processing your tax return or, worse, missing out on potential tax savings.

Additionally, having your student loan account number handy can help you keep track of your loans, especially if you have multiple loans from different servicers. It’s essential to stay organized, particularly during tax season, to ensure that you’re maximizing your deductions and filing accurately.

In summary, knowing how to find your student loan account number for IRS purposes is a vital part of managing your student loans and ensuring that your tax filings are accurate. By following the steps outlined above, you can easily locate your account number and take advantage of any tax benefits associated with your student loans. Always keep your financial documents organized and readily accessible to streamline the process during tax season. If you have any further questions or need assistance, don’t hesitate to reach out to your loan servicer or a tax professional.