Unlocking Financial Opportunities: Your Guide to SBA Loan Lookup by Name

#### Introduction to SBA Loan Lookup by NameThe **SBA Loan Lookup by Name** is an essential tool for entrepreneurs and small business owners seeking financi……

#### Introduction to SBA Loan Lookup by Name

The **SBA Loan Lookup by Name** is an essential tool for entrepreneurs and small business owners seeking financial assistance. This process allows individuals to investigate and identify specific loans issued by the Small Business Administration (SBA) using the name of the business or individual. Understanding how to navigate this resource can open doors to funding opportunities that can significantly impact the growth and sustainability of a business.

#### What is an SBA Loan?

An SBA Loan is a government-backed loan designed to help small businesses access the capital they need to start, grow, or expand their operations. The SBA collaborates with lenders to provide loans that often have favorable terms, such as lower interest rates and longer repayment periods. These loans can be used for various purposes, including purchasing equipment, real estate, or working capital.

#### Importance of SBA Loan Lookup by Name

The SBA Loan Lookup by Name feature is particularly beneficial for businesses that want to understand their financing options better. By searching for loans associated with a specific name, business owners can:

1. **Identify Funding Opportunities**: Discover available loans that they may qualify for based on their business name.

2. **Research Competitors**: Gain insights into what types of financing competitors in their industry have secured, helping them strategize their own financial approaches.

3. **Monitor Loan Activity**: Keep track of loan disbursements and repayments related to their business, ensuring they are aware of their financial standing.

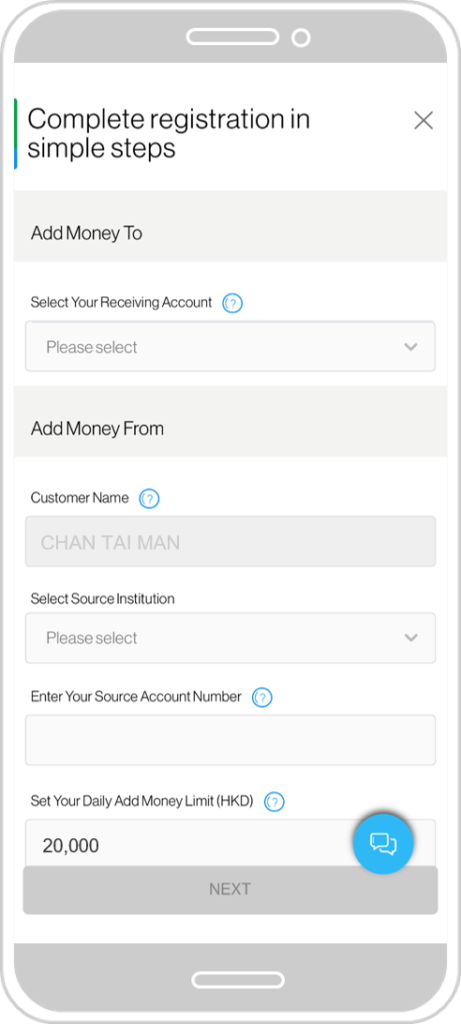

#### How to Perform an SBA Loan Lookup by Name

To conduct an SBA Loan Lookup by Name, follow these steps:

1. **Visit the SBA Website**: Start by navigating to the official SBA website, which provides a wealth of resources and tools for small business owners.

2. **Access the Loan Lookup Tool**: Look for the loan lookup tool, which may be found under the financing or loan sections of the website.

3. **Enter the Business Name**: Input the name of your business or the name of the individual you are researching. Make sure to check the spelling and format to ensure accurate results.

4. **Review the Results**: Analyze the list of loans associated with the name provided. The results may include details such as loan amounts, dates, and the types of loans secured.

#### Benefits of Using the SBA Loan Lookup Tool

Using the SBA Loan Lookup by Name tool offers several advantages:

- **Transparency**: It promotes transparency in the lending process, allowing businesses to see how funds are being distributed within their industry.

- **Informed Decision-Making**: By understanding the types of loans available and the amounts secured by others, business owners can make more informed decisions about their financing strategies.

- **Networking Opportunities**: Identifying other businesses that have received SBA loans can lead to networking opportunities and potential partnerships.

#### Conclusion

In conclusion, the SBA Loan Lookup by Name is a powerful resource for small business owners looking to navigate the complexities of financing. By utilizing this tool, entrepreneurs can uncover valuable information that can aid them in securing the funding necessary for their business endeavors. Whether you are a startup in need of initial capital or an established business looking to expand, understanding how to effectively use the SBA loan lookup can be a game-changer in your financial journey. Embrace this opportunity to unlock the potential of your business today!