"Understanding Interest Rates on Car Loans Today: What You Need to Know Before Buying Your Next Vehicle"

#### Interest Rates on Car Loans TodayIn today's ever-evolving financial landscape, understanding the interest rates on car loans today is crucial for anyon……

#### Interest Rates on Car Loans Today

In today's ever-evolving financial landscape, understanding the interest rates on car loans today is crucial for anyone looking to purchase a vehicle. With fluctuating rates influenced by various economic factors, borrowers must stay informed to make the best financial decisions.

When considering a car loan, the interest rate plays a significant role in determining the overall cost of the loan. A lower interest rate can save you thousands of dollars over the life of the loan, while a higher rate can significantly increase your monthly payments and total repayment amount. Therefore, being aware of the current interest rates on car loans today can help you budget effectively and choose the right financing option.

#### Factors Influencing Interest Rates on Car Loans

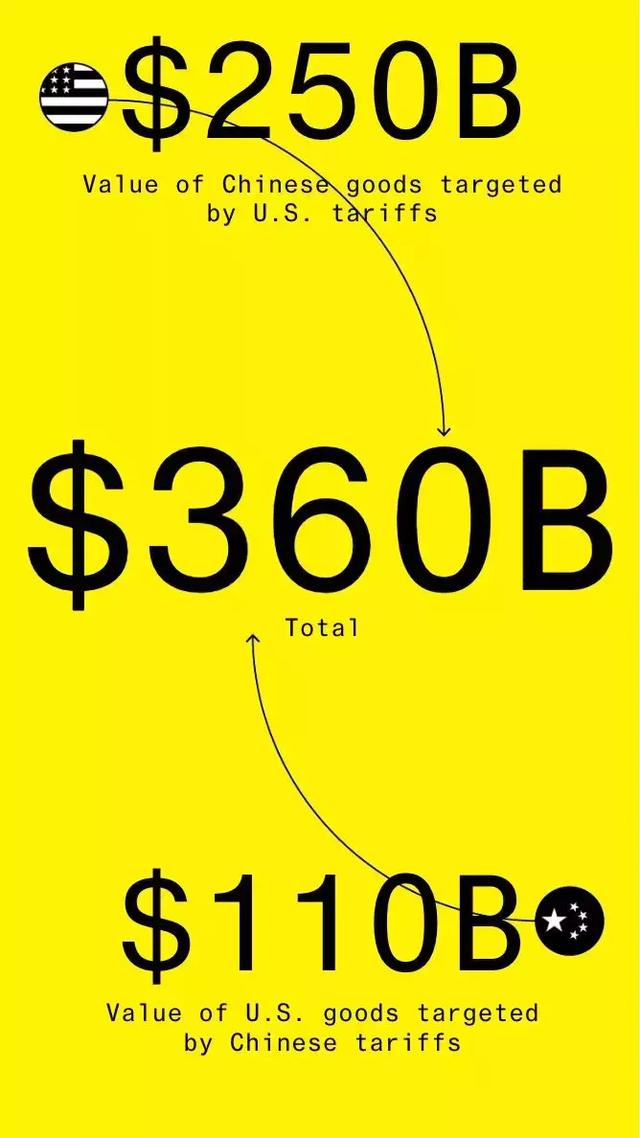

Several factors influence interest rates on car loans today. One of the primary factors is the overall economic environment, including inflation rates and the Federal Reserve's monetary policy. When the economy is strong and inflation is low, interest rates tend to be lower, making it an ideal time for consumers to secure financing for their vehicles. Conversely, during periods of economic uncertainty or rising inflation, interest rates may increase, resulting in higher borrowing costs.

Another critical factor is the borrower's credit score. Lenders assess the risk associated with lending money to an individual based on their credit history. A higher credit score typically results in lower interest rates, while a lower score can lead to higher rates. Therefore, potential borrowers should check their credit reports and work on improving their scores before applying for a car loan.

#### Types of Car Loans and Their Interest Rates

There are various types of car loans available, each with different interest rates. For instance, new car loans generally have lower interest rates compared to used car loans, as lenders view new vehicles as less risky. Additionally, loans with shorter terms typically have lower interest rates than those with longer terms, though they may come with higher monthly payments.

Understanding the different types of loans and their associated interest rates on car loans today can help you make an informed decision. For example, a traditional auto loan from a bank or credit union may offer competitive rates, while dealership financing could be higher, especially if you are not negotiating effectively.

#### How to Secure the Best Interest Rates on Car Loans

To secure the best interest rates on car loans today, consumers should take several proactive steps. First, shopping around and comparing rates from multiple lenders can help you find the most favorable terms. Online tools and resources can make this process easier, allowing you to quickly see which lenders offer the best rates for your credit profile.

Additionally, consider getting pre-approved for a loan before visiting dealerships. Pre-approval not only gives you a better understanding of the rates you qualify for but also strengthens your negotiating position when discussing financing options with dealers.

Finally, don't hesitate to negotiate. Many consumers are unaware that interest rates are often negotiable. If you receive a quote from a lender, use it as leverage to negotiate better terms with other lenders or dealerships.

#### Conclusion

In summary, understanding interest rates on car loans today is essential for making informed financial decisions when purchasing a vehicle. By staying informed about the factors that influence these rates, exploring different loan options, and taking steps to secure the best rates possible, you can ensure that your car financing aligns with your financial goals and budget. The right preparation and knowledge can lead to significant savings and a more manageable loan experience.