Understanding Student Loan Payments: Do You Get Tax Credit for Paying Student Loans?

Guide or Summary:IntroductionUnderstanding Student Loan InterestStudent Loan Interest DeductionEligibility RequirementsTax Credits vs. Tax DeductionsOther T……

Guide or Summary:

- Introduction

- Understanding Student Loan Interest

- Student Loan Interest Deduction

- Eligibility Requirements

- Tax Credits vs. Tax Deductions

- Other Tax Benefits for Education

**Translation: Do you get tax credit for paying student loans?**

---

Introduction

Navigating the world of student loans can be overwhelming, especially when it comes to understanding the financial implications of repayment. One question that frequently arises is, do you get tax credit for paying student loans? This inquiry is crucial for borrowers who want to maximize their financial benefits while managing their debt. In this article, we'll delve into the specifics of student loan payments, tax credits, and what you need to know to make informed financial decisions.

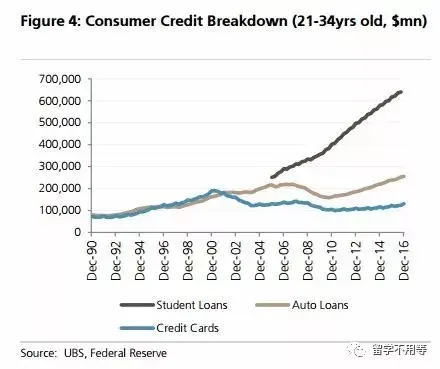

Understanding Student Loan Interest

When you take out a student loan, you are not just borrowing money; you are also agreeing to pay interest on that amount. The interest can accumulate quickly, making the total repayment amount significantly higher than the original loan. Fortunately, the IRS allows borrowers to deduct a portion of the interest paid on qualified student loans, which can lead to a potential tax credit.

Student Loan Interest Deduction

The student loan interest deduction is a tax benefit that allows you to deduct up to $2,500 of interest paid on qualified student loans from your taxable income. This deduction can reduce your overall tax burden, making it a valuable consideration for those asking, do you get tax credit for paying student loans? However, it's essential to understand that this is a deduction, not a credit. While both can reduce your tax liability, a credit is typically more beneficial because it reduces your tax bill dollar-for-dollar.

Eligibility Requirements

To qualify for the student loan interest deduction, you must meet specific criteria. The loan must be taken out solely to pay for qualified education expenses, and the borrower must be legally obligated to pay the interest. Additionally, your modified adjusted gross income (MAGI) must fall below certain thresholds to claim the deduction fully. If your MAGI exceeds these limits, the deduction may be phased out or eliminated.

Tax Credits vs. Tax Deductions

It's essential to differentiate between tax credits and tax deductions when discussing financial benefits related to student loans. A tax credit directly reduces the amount of tax you owe, while a tax deduction lowers your taxable income. Therefore, when considering do you get tax credit for paying student loans?, it's crucial to recognize that the primary benefit available is a deduction, not a credit.

Other Tax Benefits for Education

In addition to the student loan interest deduction, there are other tax benefits related to education that borrowers should be aware of. The American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) are two significant credits that can provide financial relief for students and their families. These credits are available to those who are pursuing higher education and can help offset tuition and related expenses.

In summary, while the question do you get tax credit for paying student loans? is commonly asked, the reality is that the primary financial benefit for student loan borrowers comes in the form of a tax deduction for interest paid on qualified loans. Understanding this distinction, along with eligibility requirements and other available tax benefits, can help borrowers make the most of their financial situation. As you navigate your student loan repayment journey, consider consulting a tax professional to ensure you are maximizing your benefits and making informed decisions about your financial future.