Understanding What is a Payday Loan: A Comprehensive Guide to Short-Term Borrowing

Guide or Summary:What is a Payday LoanHow Payday Loans WorkAdvantages of Payday LoansDisadvantages of Payday LoansAlternatives to Payday LoansWhat is a Payd……

Guide or Summary:

- What is a Payday Loan

- How Payday Loans Work

- Advantages of Payday Loans

- Disadvantages of Payday Loans

- Alternatives to Payday Loans

What is a Payday Loan

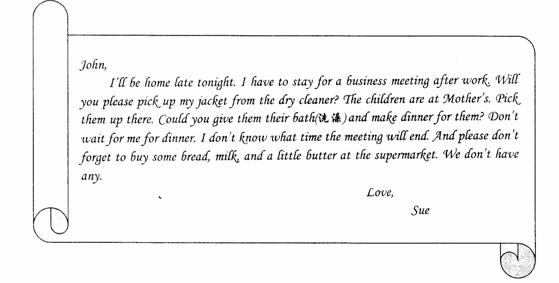

A payday loan is a type of short-term borrowing where a lender extends credit based on your income, typically requiring repayment by your next payday. These loans are often marketed as a quick solution for those who need cash urgently and can be appealing for individuals facing unexpected expenses. However, understanding the implications of taking out a payday loan is crucial before making a decision.

How Payday Loans Work

The process of obtaining a payday loan is relatively straightforward. Borrowers apply for a loan amount that is often a fraction of their monthly income, and lenders typically require proof of employment and a bank account. Once approved, the borrower receives the funds, which they are expected to repay, along with interest and fees, on their next payday.

Advantages of Payday Loans

One of the main advantages of payday loans is their accessibility. They are often available to individuals with poor credit scores who may not qualify for traditional bank loans. Additionally, the application process is usually quick, with many lenders offering online services that allow borrowers to receive funds within a matter of hours. This speed can be critical in emergencies, such as medical expenses or car repairs.

Disadvantages of Payday Loans

Despite their convenience, payday loans come with significant drawbacks. The most notable is the high-interest rates associated with them. APRs can soar into the triple digits, making it easy for borrowers to fall into a cycle of debt if they cannot repay the loan on time. Failure to repay can lead to additional fees and the potential for the loan to be rolled over, further increasing the debt.

Alternatives to Payday Loans

Given the risks associated with payday loans, it is essential to consider alternatives. Options such as personal loans from banks or credit unions, credit cards with lower interest rates, or even borrowing from friends or family can be more financially sound choices. Additionally, some nonprofit organizations offer assistance programs for individuals facing financial hardships.

In summary, while payday loans can provide quick access to cash, they come with significant risks and costs that should not be overlooked. Understanding what is a payday loan, how it works, and the potential consequences of taking one out is vital for anyone considering this option. Always explore alternative solutions and ensure you are making informed financial decisions to avoid falling into a cycle of debt.