"Essential Guide to Securing Loans for Bad Credit Emergency Situations"

#### Description:In today's unpredictable financial landscape, many individuals find themselves facing unforeseen expenses that require immediate attention……

#### Description:

In today's unpredictable financial landscape, many individuals find themselves facing unforeseen expenses that require immediate attention. Whether it's a medical emergency, car repair, or unexpected bills, having access to funds quickly can be crucial. For those with less-than-perfect credit scores, the search for financial assistance can be particularly daunting. This is where **loans for bad credit emergency** come into play, offering a lifeline for individuals in urgent need of cash.

**Understanding Loans for Bad Credit Emergency**

**Loans for bad credit emergency** are specifically designed for individuals who may not qualify for traditional loans due to their credit history. These loans can be a viable option for those who need money quickly but have a poor credit score. They typically come with higher interest rates and less favorable terms compared to standard loans, but they provide a necessary solution for urgent financial needs.

**Types of Loans Available**

When considering **loans for bad credit emergency**, borrowers have several options:

1. **Payday Loans**: These short-term loans are designed to cover expenses until the borrower receives their next paycheck. While they offer quick access to cash, they often come with exorbitant interest rates and fees.

2. **Personal Loans**: Some lenders specialize in personal loans for individuals with bad credit. These loans can be used for various purposes, including consolidating debt or covering emergency expenses.

3. **Title Loans**: If you own a vehicle, title loans allow you to borrow against the value of your car. This can be a quick way to access cash, but it also puts your vehicle at risk if you fail to repay the loan.

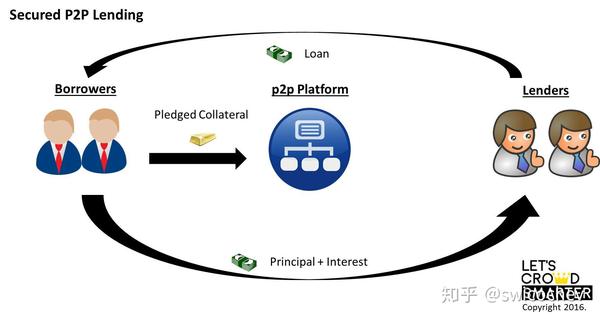

4. **Peer-to-Peer Lending**: This platform connects borrowers with individual investors willing to lend money. While interest rates can vary, this option may offer more favorable terms than traditional lenders.

**How to Qualify for Loans for Bad Credit Emergency**

Qualifying for **loans for bad credit emergency** typically involves a few basic requirements:

- **Proof of Income**: Lenders want to ensure you have a reliable source of income to repay the loan.

- **Identification**: A government-issued ID to verify your identity.

- **Bank Account**: Most lenders require a checking account for fund disbursement and repayment.

**Steps to Secure a Loan**

1. **Research Lenders**: Start by researching lenders that specialize in loans for bad credit. Compare terms, interest rates, and customer reviews to find a trustworthy option.

2. **Determine the Loan Amount**: Assess how much money you need and ensure it aligns with what lenders are willing to offer.

3. **Prepare Your Documentation**: Gather necessary documents, such as proof of income and identification, to streamline the application process.

4. **Apply for the Loan**: Complete the application process, which can often be done online for convenience.

5. **Review the Terms**: Before accepting any loan, carefully review the terms and conditions, including interest rates and repayment schedules.

**Conclusion**

While **loans for bad credit emergency** can provide immediate financial relief, it’s essential to approach them with caution. Understanding the terms and implications of these loans can help borrowers make informed decisions that best suit their financial situation. Always consider alternative options and ensure that you can manage the repayment to avoid further financial strain. In times of crisis, these loans can be a necessary step toward regaining control of your finances.