Understanding Student Loan Limits for Undergraduate Students: What You Need to Know

#### Student Loan Limits for Undergraduate StudentsWhen it comes to financing your education, understanding the student loan limits for undergraduate studen……

#### Student Loan Limits for Undergraduate Students

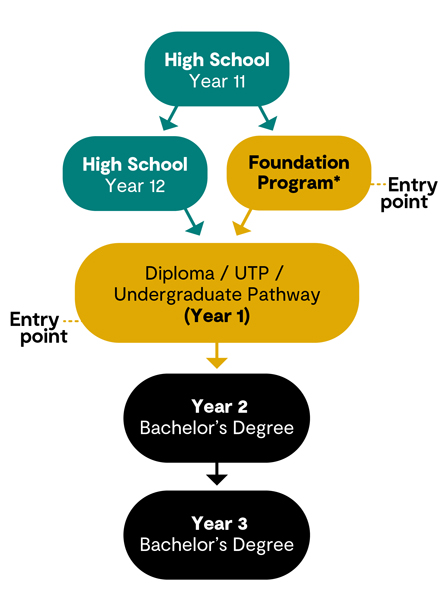

When it comes to financing your education, understanding the student loan limits for undergraduate students is crucial. These limits dictate how much money you can borrow through federal student loans, which can significantly impact your financial planning and overall college experience. In this article, we will explore the various types of federal student loans available to undergraduate students, the specific limits imposed, and tips for managing your student loan debt effectively.

#### Types of Federal Student Loans

Undergraduate students primarily have access to two types of federal loans: Direct Subsidized Loans and Direct Unsubsidized Loans.

1. **Direct Subsidized Loans**: These loans are available to students who demonstrate financial need. The government pays the interest on these loans while you are in school at least half-time, during the grace period, and during deferment periods. This can save you a significant amount of money over the life of the loan.

2. **Direct Unsubsidized Loans**: Unlike subsidized loans, these are available to all undergraduate students regardless of financial need. However, you are responsible for paying the interest on these loans from the time they are disbursed. If you choose not to pay the interest while in school, it will accrue and be added to your principal balance, increasing the total amount you owe.

#### Loan Limits

The student loan limits for undergraduate students vary based on your year in school and whether you are a dependent or independent student.

- **Dependent Students**:

- First-Year: Up to $3,500 in Direct Subsidized Loans and $2,000 in Direct Unsubsidized Loans (total of $5,500).

- Second-Year: Up to $4,500 in Direct Subsidized Loans and $2,000 in Direct Unsubsidized Loans (total of $6,500).

- Third-Year and Beyond: Up to $5,500 in Direct Subsidized Loans and $2,000 in Direct Unsubsidized Loans (total of $7,500).

- **Independent Students**:

- First-Year: Up to $3,500 in Direct Subsidized Loans and $6,000 in Direct Unsubsidized Loans (total of $9,500).

- Second-Year: Up to $4,500 in Direct Subsidized Loans and $6,000 in Direct Unsubsidized Loans (total of $10,500).

- Third-Year and Beyond: Up to $5,500 in Direct Subsidized Loans and $7,000 in Direct Unsubsidized Loans (total of $12,500).

These limits are set annually and can change based on federal regulations. It's important to stay informed about any updates that may affect your borrowing capacity.

#### Managing Your Student Loans

Understanding the student loan limits for undergraduate students is just the first step; managing your loans wisely is equally important. Here are some tips:

1. **Borrow Only What You Need**: While it might be tempting to borrow the maximum amount, consider your actual expenses. Only take out what you need to cover tuition, fees, and necessary living expenses.

2. **Keep Track of Your Debt**: Regularly review your loan balances and interest rates. This will help you understand how much you owe and how quickly your debt is growing.

3. **Explore Repayment Options**: Familiarize yourself with the different repayment plans available after graduation. Options like income-driven repayment plans can help make your monthly payments more manageable.

4. **Consider Loan Forgiveness Programs**: If you plan to work in certain public service sectors, you may qualify for loan forgiveness after a specified number of payments.

5. **Stay Informed**: Keep an eye on any changes in federal loan policies, as they can impact your borrowing and repayment options.

In conclusion, knowing the student loan limits for undergraduate students is essential for effective financial planning during your college years. By understanding the types of loans available, their limits, and how to manage your debt, you can make informed decisions that will benefit you in the long run.