Understanding the Impact of Federal Student Loans Rate on Your Education Financing

#### What is Federal Student Loans Rate?The **federal student loans rate** refers to the interest rates set by the government for various types of federal s……

#### What is Federal Student Loans Rate?

The **federal student loans rate** refers to the interest rates set by the government for various types of federal student loans. These loans are designed to help students cover the cost of their education, including tuition, fees, and living expenses. The rates can vary based on the type of loan, the year the loan was issued, and whether the borrower is an undergraduate or graduate student. Understanding these rates is crucial for students and families planning to finance higher education.

#### Types of Federal Student Loans

There are several types of federal student loans, each with its own interest rate structure. The most common types include:

1. **Direct Subsidized Loans**: Available to undergraduate students with financial need, these loans do not accrue interest while the borrower is in school at least half-time.

2. **Direct Unsubsidized Loans**: These loans are available to both undergraduate and graduate students and do accrue interest from the time the loan is disbursed.

3. **Direct PLUS Loans**: Designed for graduate or professional students and parents of dependent undergraduate students, these loans have a higher interest rate compared to subsidized and unsubsidized loans.

4. **Direct Consolidation Loans**: These allow borrowers to combine multiple federal student loans into a single loan with a fixed interest rate based on the weighted average of the loans being consolidated.

.jpg)

#### Current Federal Student Loans Rate

The **federal student loans rate** is adjusted annually and is influenced by various factors, including the economic climate and government policies. As of the latest updates, the rates for new loans for the 2023-2024 academic year are as follows:

- Direct Subsidized Loans: X%

- Direct Unsubsidized Loans: Y%

- Direct PLUS Loans: Z%

It is essential for potential borrowers to stay informed about these rates as they can significantly impact the total cost of borrowing.

#### How Federal Student Loans Rate Affects Borrowers

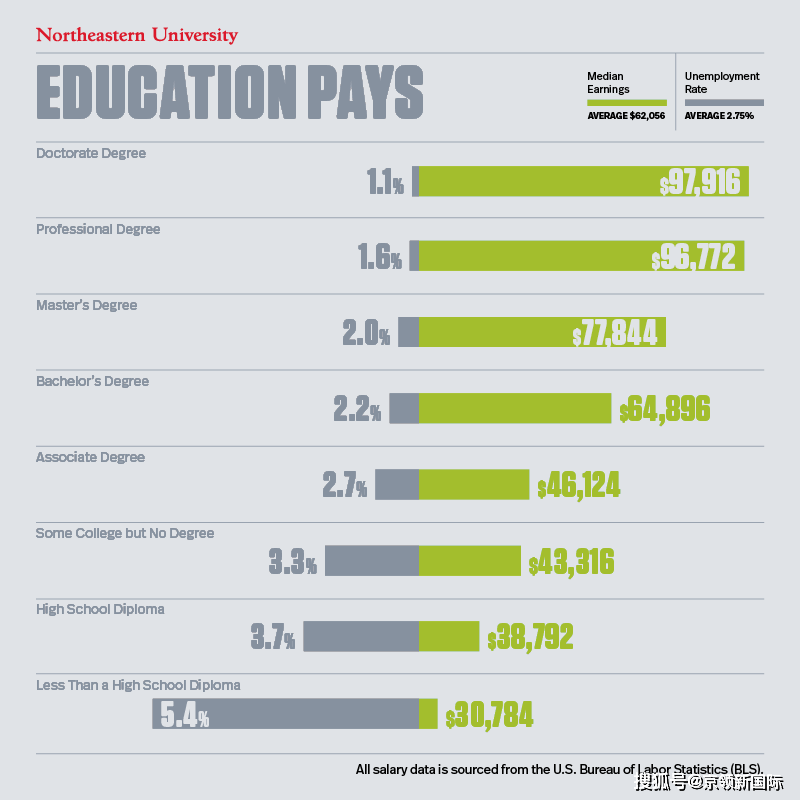

The **federal student loans rate** directly impacts the amount of interest students will pay over the life of their loans. A lower interest rate means that borrowers will pay less in interest, making it more manageable to repay the loan after graduation. Conversely, a higher interest rate can lead to substantial financial burdens, especially for those who may struggle to find employment after completing their education.

#### Strategies to Manage Federal Student Loans

To effectively manage the burden of federal student loans, borrowers can consider the following strategies:

1. **Understand Loan Terms**: Familiarize yourself with the terms of your loans, including interest rates, repayment options, and potential forgiveness programs.

2. **Create a Budget**: Develop a budget that accounts for loan repayments after graduation. This will help ensure that you can manage your finances effectively.

3. **Explore Repayment Plans**: Federal student loans offer various repayment plans, including income-driven repayment options that can adjust monthly payments based on income.

4. **Consider Loan Forgiveness Programs**: Some federal student loans may be eligible for forgiveness after a certain number of qualifying payments, especially for those in public service careers.

#### Conclusion

In conclusion, understanding the **federal student loans rate** is crucial for anyone considering borrowing for education. By staying informed about current rates, types of loans, and effective management strategies, borrowers can make informed decisions that will benefit their financial future. As the landscape of education financing continues to evolve, it is important for students and families to remain proactive in their approach to managing federal student loans.