In-Depth Analysis of Prosper Loan Approved but Not Funded Reviews: What Borrowers Need to Know

Guide or Summary:Introduction to Prosper LoansUnderstanding the Approval ProcessReasons for Non-FundingBorrower Experiences: Reviews and FeedbackWhat to Do……

Guide or Summary:

- Introduction to Prosper Loans

- Understanding the Approval Process

- Reasons for Non-Funding

- Borrower Experiences: Reviews and Feedback

- What to Do If Your Loan Is Approved but Not Funded

- Conclusion: Navigating the Prosper Loan Landscape

**Translation**: Prosper loan approved but not funded reviews

---

Introduction to Prosper Loans

Prosper is a peer-to-peer lending platform that connects borrowers with investors. It offers personal loans for various purposes, such as debt consolidation, home improvement, and medical expenses. Many borrowers find Prosper appealing due to its competitive interest rates and flexible terms. However, a common issue that arises is the situation where a loan is approved but not funded, leading to confusion and frustration among borrowers.

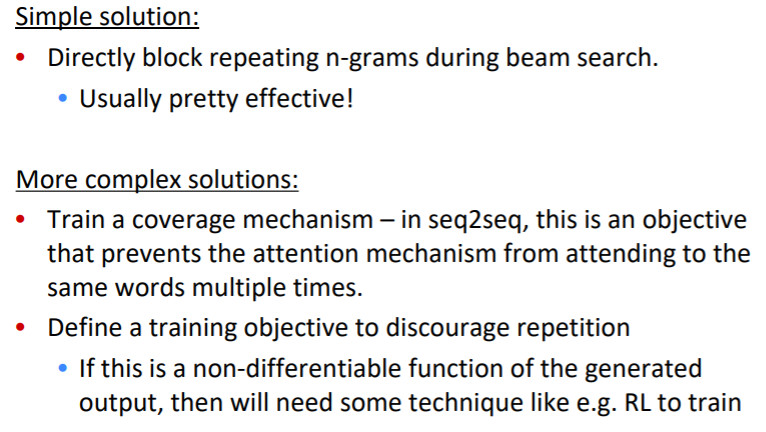

Understanding the Approval Process

When you apply for a Prosper loan, the application undergoes a thorough review. This includes a credit check, income verification, and an assessment of your creditworthiness. If you receive an approval notice, it indicates that Prosper has deemed you eligible for a loan based on their criteria. However, approval does not guarantee funding.

Reasons for Non-Funding

There are several reasons why a loan may be approved but not funded. One significant factor is the lack of available investors willing to finance your loan. Prosper operates on a marketplace model where investors choose which loans to fund. If your loan does not attract enough investor interest, it may remain unfunded despite being approved.

Another reason could be changes in your financial situation after approval. If there are significant changes, such as a drop in your credit score or changes in income, it may lead to the loan being unfunded. Additionally, if the loan amount requested exceeds the maximum funding limits set by Prosper, this can also result in non-funding.

Borrower Experiences: Reviews and Feedback

Many borrowers have shared their experiences regarding the "Prosper loan approved but not funded" situation. Reviews often highlight the disappointment and confusion that arise when a loan is approved but does not proceed to funding. Some borrowers express frustration over the lack of communication from Prosper regarding the status of their loans.

Others note that the process can be lengthy, with some waiting weeks or even months for funding that never materializes. These experiences underscore the importance of understanding the dynamics of the peer-to-peer lending model and the role of investor participation.

What to Do If Your Loan Is Approved but Not Funded

If you find yourself in a situation where your Prosper loan is approved but not funded, there are a few steps you can take. First, reach out to Prosper’s customer service for clarification on your loan status. They can provide insights into why funding has not occurred and what options you may have.

Consider adjusting your loan request. If your initial request was for a high amount, lowering it might attract more investors. Additionally, ensure that your credit profile remains strong during the waiting period. This involves making timely payments on existing debts and avoiding new credit inquiries.

Conclusion: Navigating the Prosper Loan Landscape

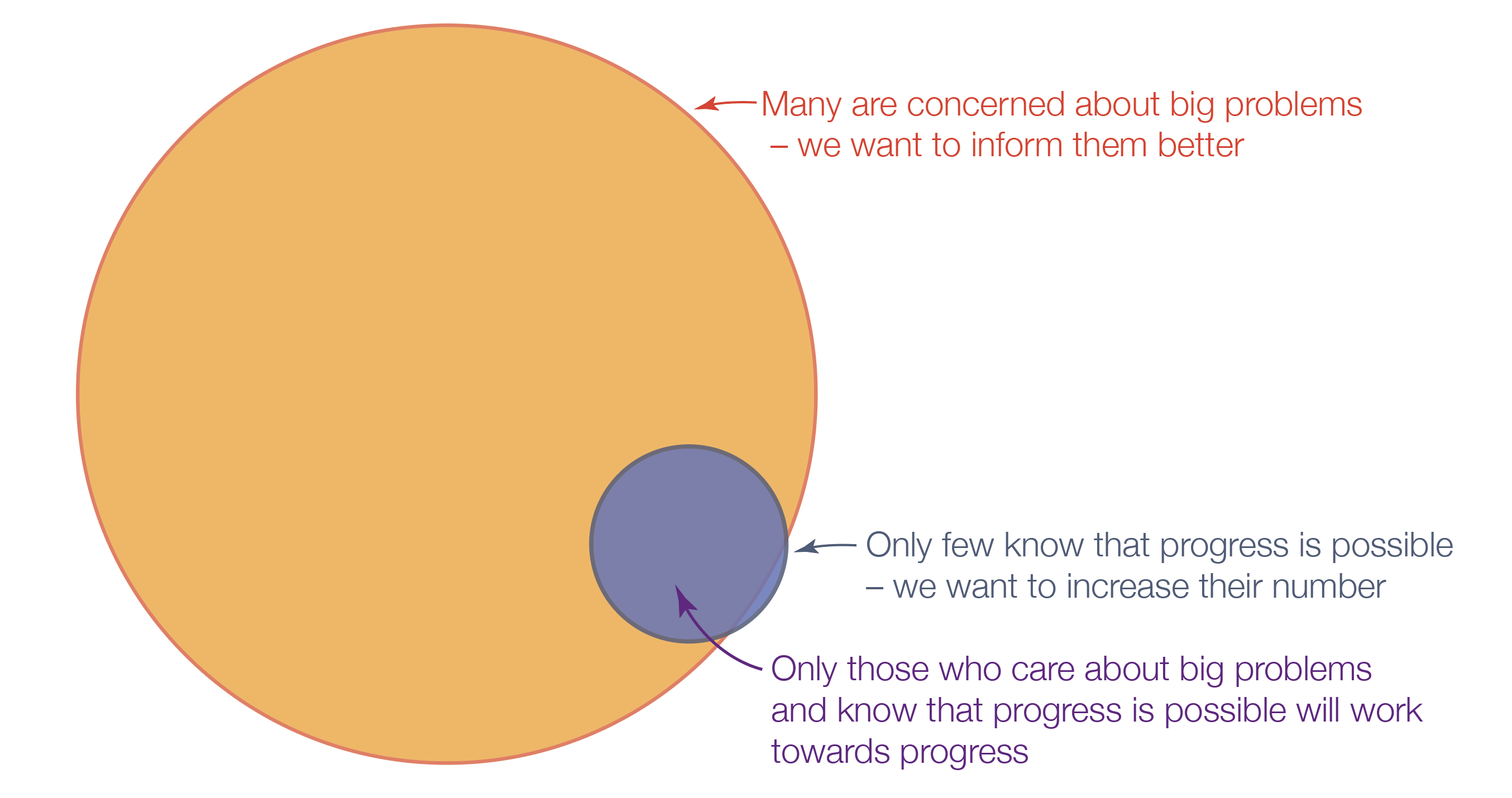

Understanding the intricacies of Prosper loans, especially the nuances of being approved but not funded, is crucial for potential borrowers. While the platform offers a viable solution for personal financing, it's essential to be aware of the potential pitfalls and prepare accordingly. By staying informed and proactive, borrowers can better navigate the challenges of peer-to-peer lending and increase their chances of securing the funds they need.

In summary, while receiving an approval from Prosper is a positive step, it is vital to understand that funding is not guaranteed. By exploring reviews and learning from the experiences of others, borrowers can equip themselves with the knowledge to handle any obstacles that may arise during the loan process.