Can You Use Credit Card to Pay Off Loan? Exploring the Pros and Cons of This Financial Strategy

#### Can you use credit card to pay off loan?In today's fast-paced financial landscape, many individuals find themselves grappling with debt. When it comes……

#### Can you use credit card to pay off loan?

In today's fast-paced financial landscape, many individuals find themselves grappling with debt. When it comes to managing loans, a common question arises: **can you use credit card to pay off loan?** This inquiry is particularly relevant for those seeking immediate relief from high-interest loans or looking to consolidate their debts. However, while using a credit card to pay off a loan might seem like a quick fix, it is essential to weigh the pros and cons before making such a decision.

#### Understanding the Basics

To begin with, let's clarify what it means to use a credit card to pay off a loan. Essentially, this involves taking funds from a credit card—often through a cash advance or balance transfer—and using that money to settle an existing loan. This method can offer short-term relief, especially if the credit card has a lower interest rate than the loan. However, it also comes with its own set of risks and considerations.

#### Pros of Using a Credit Card to Pay Off a Loan

1. **Lower Interest Rates**: If you have a credit card with a promotional 0% APR for balance transfers, this can be an excellent way to manage your debt. Transferring your loan balance to this card can save you money on interest in the short term.

2. **Simplified Payments**: Consolidating multiple loans into a single credit card payment can simplify your monthly budgeting. Instead of juggling several due dates and amounts, you’ll only need to manage one payment.

3. **Flexible Repayment Options**: Credit cards often provide more flexible repayment options compared to traditional loans. You can pay off the balance as you see fit, provided you meet the minimum payment requirements.

#### Cons of Using a Credit Card to Pay Off a Loan

1. **Higher Interest Rates Post-Promotional Period**: Once the promotional balance transfer period ends, the interest rate on your credit card may increase significantly. If you haven’t paid off the balance by then, you could end up paying more in interest than you would have with your original loan.

2. **Impact on Credit Score**: Utilizing a significant portion of your credit limit can negatively impact your credit score. This is known as your credit utilization ratio, and a high ratio can signal to lenders that you are financially overextended.

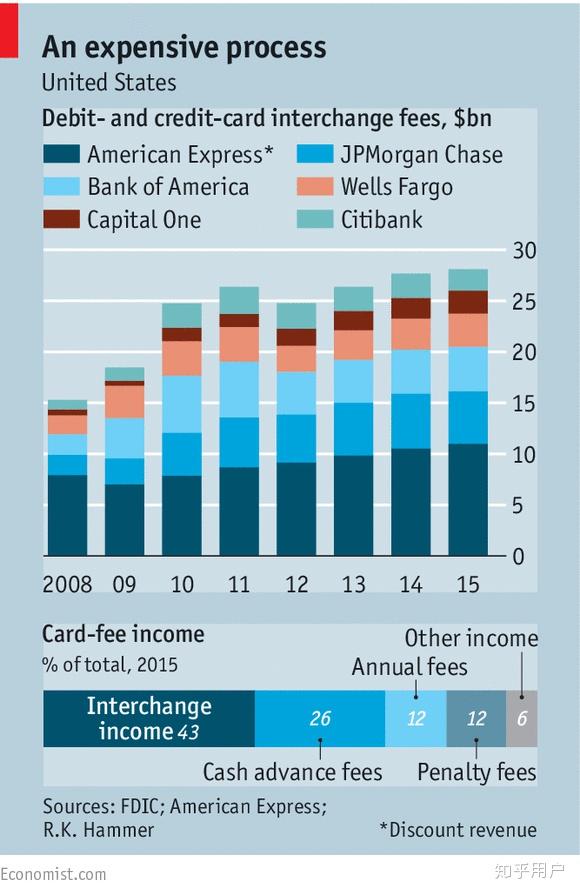

3. **Fees and Charges**: Many credit cards charge fees for cash advances or balance transfers, which can eat into any potential savings you might gain from lower interest rates.

#### Conclusion

In conclusion, the question **can you use credit card to pay off loan?** is not merely a yes or no answer; it requires careful consideration of your financial situation. While it can offer some immediate benefits, such as lower interest rates and simplified payments, it also carries risks that could lead to greater financial strain in the long run. Before making this decision, it is advisable to explore all your options, including personal loans, debt consolidation services, or even speaking with a financial advisor. Understanding the full scope of your financial landscape will help you make an informed choice that aligns with your long-term financial goals.