Unlocking Opportunities: A Comprehensive Guide to Canada Alberta Student Loans

#### Canada Alberta Student LoansIn Canada, education is often seen as a pathway to success, but the rising costs of tuition can be a significant barrier fo……

#### Canada Alberta Student Loans

In Canada, education is often seen as a pathway to success, but the rising costs of tuition can be a significant barrier for many students. This is especially true in Alberta, where the demand for higher education continues to grow. Understanding the various options available for financing your education is crucial, and one of the most important resources available to students in Alberta is the Canada Alberta Student Loans program.

#### What are Canada Alberta Student Loans?

The Canada Alberta Student Loans program is a financial assistance initiative designed to help students cover the costs associated with post-secondary education. This program is a collaboration between the federal and provincial governments, aimed at providing loans to eligible students who may not have the financial means to pay for their education upfront.

These loans are intended to cover tuition fees, books, and living expenses, ensuring that students can focus on their studies rather than worrying about financial burdens. The loans are repayable, but the terms are designed to be manageable, with flexible repayment options available after graduation.

#### Eligibility Criteria

To qualify for Canada Alberta Student Loans, students must meet specific criteria, including residency requirements, enrollment in an eligible program, and demonstrating financial need. Typically, students must be Canadian citizens, permanent residents, or designated as protected persons. Additionally, they should be enrolled in a full-time or part-time program at a recognized post-secondary institution.

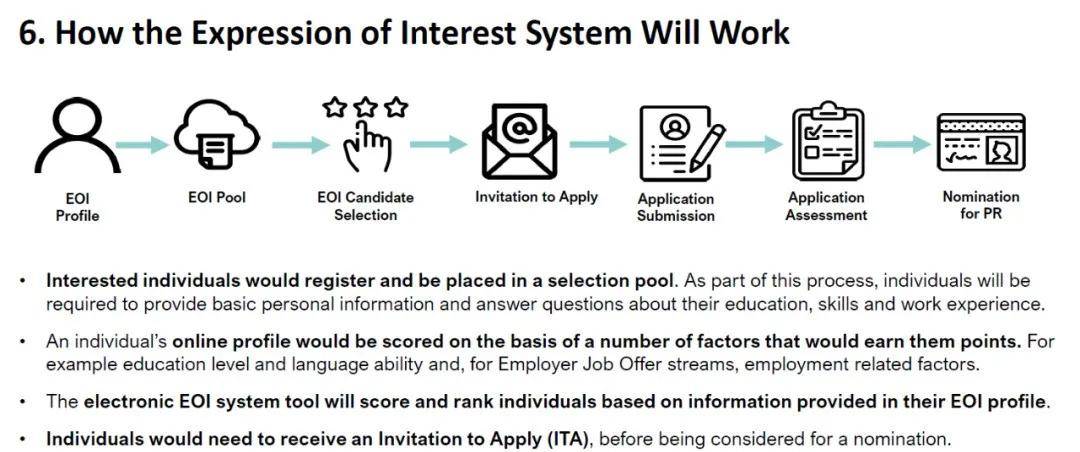

#### Application Process

The application process for Canada Alberta Student Loans is straightforward but requires careful attention to detail. Students must complete the application form, which can be found online through the Alberta Student Aid website. It’s essential to gather all necessary documents, including proof of income, tuition costs, and other relevant financial information.

Once the application is submitted, students will receive a notice of assessment, detailing how much funding they are eligible for. This assessment will consider the student’s financial situation, including income, assets, and family contributions.

#### Types of Funding Available

The Canada Alberta Student Loans program offers various types of funding, including:

1. **Loans**: These are the primary form of financial assistance, which must be repaid after graduation, typically starting six months after completing studies.

2. **Grants**: Unlike loans, grants do not need to be repaid. They are awarded based on financial need and can significantly reduce the overall cost of education.

3. **Bursaries**: These are similar to grants but may have specific eligibility criteria, such as academic performance or community involvement.

#### Repayment Options

Repaying Canada Alberta Student Loans can be daunting, but the program offers several options to ease the burden. Graduates can choose from various repayment plans, including income-based repayment, which adjusts monthly payments according to the borrower’s income. Additionally, there are options for loan forgiveness for those who work in specific public service roles.

#### Conclusion

Navigating the world of student loans can be overwhelming, but understanding the Canada Alberta Student Loans program is a vital step for any student looking to further their education in Alberta. By taking advantage of the financial assistance available, students can focus on their studies and future careers without the constant worry of financial strain. Whether you’re a new student or returning to school, exploring your options for funding through Canada Alberta Student Loans could be the key to unlocking your educational aspirations.