Understanding the Reasons Behind Why Do Banks Sell Mortgage Loans: A Comprehensive Guide

#### Why Do Banks Sell Mortgage LoansWhen it comes to home financing, many prospective homeowners often wonder, **"Why do banks sell mortgage loans?"** This……

#### Why Do Banks Sell Mortgage Loans

When it comes to home financing, many prospective homeowners often wonder, **"Why do banks sell mortgage loans?"** This question not only reflects an interest in the mechanics of banking but also highlights the broader implications of mortgage financing in the economy. In this guide, we will delve deep into the reasons banks engage in the sale of mortgage loans, the benefits for both banks and consumers, and how this practice impacts the housing market.

#### The Mechanics of Mortgage Loans

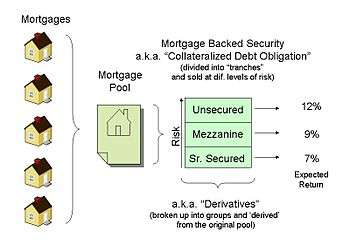

Mortgage loans are essentially loans secured by real estate property. When a bank provides a mortgage, it is essentially lending the borrower money to purchase a home. The borrower agrees to repay this loan over a specified period, typically 15 to 30 years, with interest. However, banks do not always hold onto these loans for the entire duration. Instead, they often sell them to investors or other financial institutions.

#### Why Do Banks Sell Mortgage Loans?

1. **Liquidity Management**: One of the primary reasons banks sell mortgage loans is to maintain liquidity. By selling mortgages, banks can free up capital that can be used for other lending opportunities. This is crucial for banks to meet the demands of new borrowers without having to wait for existing loans to be paid off.

2. **Risk Mitigation**: Selling mortgage loans allows banks to transfer the risk associated with these loans to other investors. By offloading these loans, banks can reduce their exposure to potential defaults, which can be particularly beneficial during economic downturns when borrowers may struggle to make payments.

3. **Profit Generation**: Banks can also profit from selling mortgage loans. When they originate a loan, they may charge fees for processing and underwriting. Additionally, they can sell the loan at a premium to investors, generating immediate revenue.

4. **Regulatory Requirements**: Banks are subject to various regulatory requirements that dictate how much capital they must hold against their loans. By selling mortgage loans, banks can lower their capital requirements, allowing them to operate more efficiently.

5. **Market Demand**: There is a robust market for mortgage-backed securities (MBS), which are created when banks bundle and sell groups of mortgage loans to investors. This demand for MBS further incentivizes banks to sell their mortgage loans, as it provides an additional revenue stream.

6. **Focus on Core Business**: By selling off mortgage loans, banks can focus on their core business activities, such as deposit-taking and offering other financial services. This allows them to streamline operations and improve overall efficiency.

#### Impacts on Consumers and the Housing Market

The practice of banks selling mortgage loans has significant implications for consumers and the housing market. For consumers, it often means that they can access a wider array of mortgage products and potentially better rates, as banks are incentivized to compete for business.

Moreover, the sale of mortgage loans contributes to the overall health of the housing market. By ensuring that banks have the liquidity to lend, more individuals can obtain mortgages, facilitating home purchases and stimulating economic growth.

#### Conclusion

In conclusion, understanding **"Why do banks sell mortgage loans?"** reveals the complex interplay between banking practices, risk management, and market dynamics. This process not only benefits the banks by enhancing liquidity and reducing risk but also serves to support consumers and the broader economy. As the housing market continues to evolve, the strategies employed by banks in selling mortgage loans will remain a critical aspect of the financial landscape.