First Commonwealth Federal Credit Union Loan Payment: A Comprehensive Guide to Managing Your Mortgage Payments

Guide or Summary:Mortgage Payments ExplainedManaging Your Mortgage PaymentsPaying Your Mortgage Online with First Commonwealth Federal Credit UnionWhen it c……

Guide or Summary:

- Mortgage Payments Explained

- Managing Your Mortgage Payments

- Paying Your Mortgage Online with First Commonwealth Federal Credit Union

When it comes to homeownership, one of the most crucial aspects to understand is your mortgage payments. As a member of the First Commonwealth Federal Credit Union, you're likely to have questions about how to make your loan payments and ensure you're staying on top of your financial obligations. This guide delves into the specifics of managing your mortgage payments with First Commonwealth Federal Credit Union, offering insights into the process, tips for keeping your payments on track, and how to make payments online for convenience.

Mortgage Payments Explained

A mortgage payment typically includes several components: the principal amount, interest, property taxes, homeowner's insurance, and sometimes mortgage insurance or private mortgage insurance (PMI). Understanding these components is the first step in managing your mortgage payments effectively.

The principal is the amount you're borrowing from the lender, and it decreases over time as you make payments. Interest is the fee you pay for borrowing money, and it varies based on the interest rate and the term of your loan. Property taxes are the fees you pay to the local government for owning property, and they vary by location. Homeowner's insurance protects your property from potential damages, and the cost depends on the value of your home and the level of coverage you choose. Mortgage insurance is required if you have a down payment of less than 20%, and it protects the lender in case you default on your loan.

Managing Your Mortgage Payments

Managing your mortgage payments involves several steps, from setting up automatic payments to understanding your payment schedule. Here's how you can manage your mortgage payments effectively:

1. **Understand Your Payment Schedule**: Your mortgage payment schedule will detail when your payments are due and how much you need to pay each month. Make sure you have a clear understanding of your payment schedule to avoid late payments.

2. **Set Up Automatic Payments**: Most lenders offer the option to set up automatic payments, which can help ensure you never miss a payment. This also helps you avoid late fees and penalties.

3. **Monitor Your Account**: Regularly check your mortgage account to ensure all payments are being made on time. If you notice any discrepancies, contact your lender immediately.

4. **Pay Extra When Possible**: If you have extra funds available, consider paying more than the minimum payment each month. This can help you pay off your mortgage faster and save on interest.

5. **Refinance Your Mortgage**: If interest rates have dropped since you took out your mortgage, consider refinancing to get a lower interest rate and reduce your monthly payments.

Paying Your Mortgage Online with First Commonwealth Federal Credit Union

First Commonwealth Federal Credit Union offers several online tools to help you manage your mortgage payments. Here are some of the features you can take advantage of:

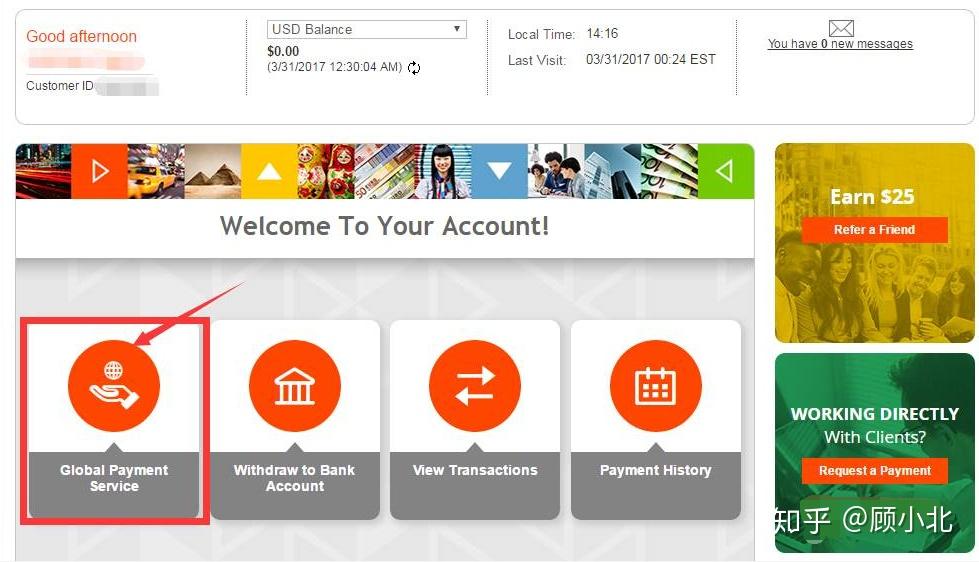

1. **Online Banking**: With online banking, you can view your mortgage account balance, payment history, and upcoming due dates. You can also make payments online, which is convenient and helps you avoid mailing checks.

2. **Mobile Banking**: First Commonwealth Federal Credit Union's mobile banking app allows you to manage your mortgage payments on the go. You can view your account balance, make payments, and even set up payment reminders.

3. **Payment Alerts**: Set up payment alerts to receive notifications when your mortgage payment is due. This can help you avoid late fees and ensure you're staying on top of your financial obligations.

In conclusion, managing your mortgage payments with First Commonwealth Federal Credit Union involves understanding your payment schedule, setting up automatic payments, monitoring your account, paying extra when possible, and taking advantage of online tools. By following these tips, you can ensure you're staying on top of your mortgage payments and securing your financial future.