Market Loans: Unlocking Opportunities for Growth, Innovation, and Competitive Advantage

Guide or Summary:What are Market Loans?How Market Loans Can Drive Growth and InnovationSecuring a Competitive EdgeManaging Risk and Securing Your FutureIn t……

Guide or Summary:

- What are Market Loans?

- How Market Loans Can Drive Growth and Innovation

- Securing a Competitive Edge

- Managing Risk and Securing Your Future

In today's fast-paced business environment, staying ahead of the competition requires not just innovative ideas and strategies but also the financial resources to bring them to life. Market loans are a powerful tool that businesses can leverage to fuel growth, drive innovation, and secure a competitive edge. By understanding how market loans work and how they can be used effectively, businesses can unlock a world of opportunities that can lead to long-term success.

What are Market Loans?

Market loans are a type of loan that is designed to provide businesses with the financial resources they need to grow and innovate. Unlike traditional loans, market loans are typically secured by the market value of the business's assets or the collateral provided by the business owner. This makes them an attractive option for businesses that may not have a traditional credit history or a strong financial track record.

How Market Loans Can Drive Growth and Innovation

One of the most significant benefits of market loans is their ability to provide businesses with the financial resources they need to grow and innovate. With access to the capital they need, businesses can invest in new products, services, and technologies that can help them stay competitive and attract new customers.

Market loans can also be used to expand a business's market reach. By providing the financial resources needed to enter new markets or invest in marketing and advertising campaigns, businesses can grow their customer base and increase their revenue streams.

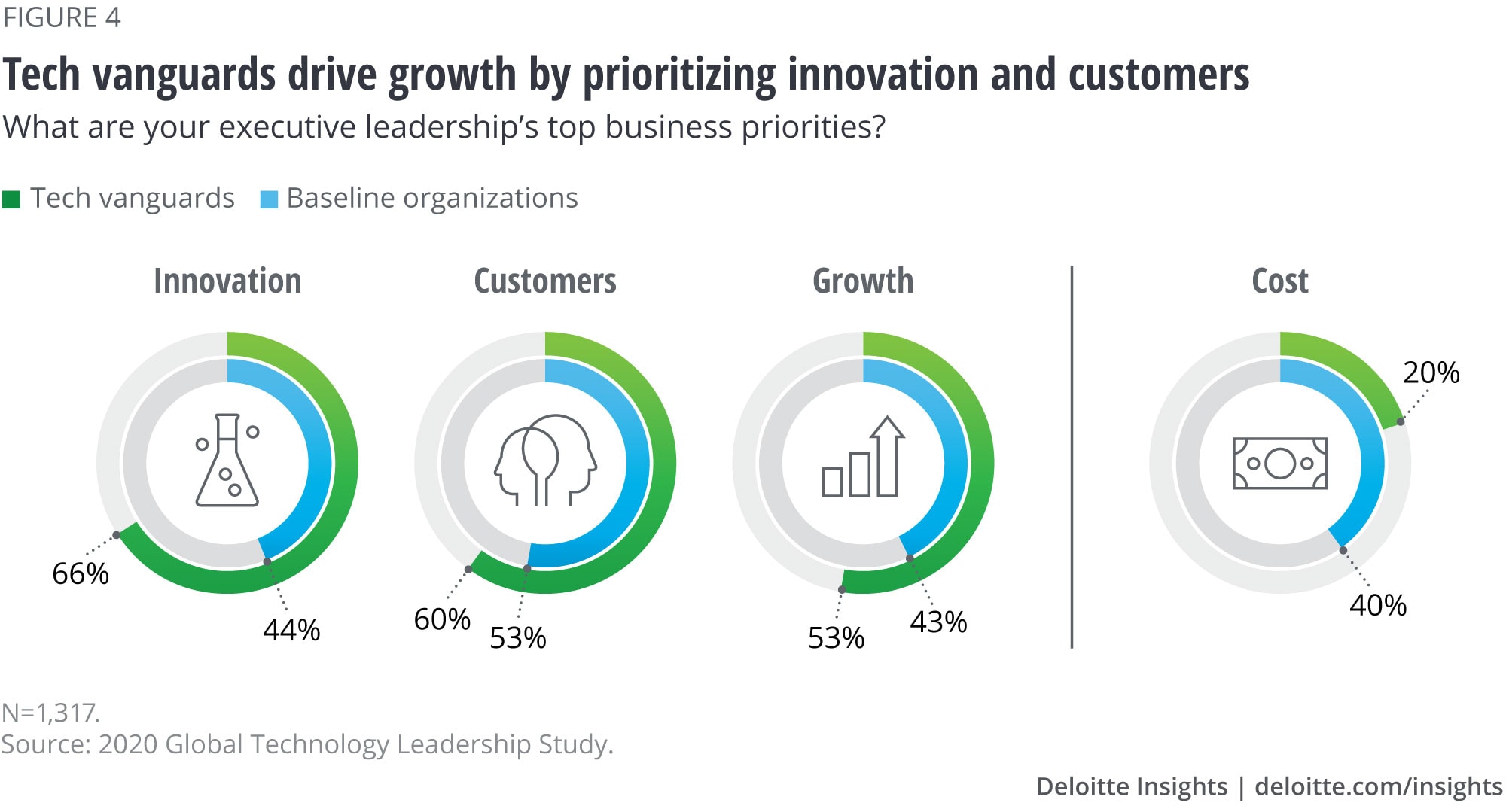

Securing a Competitive Edge

In today's highly competitive business environment, securing a competitive edge is essential for long-term success. Market loans can provide businesses with the financial resources they need to invest in research and development, hire top talent, and improve their overall operational efficiency. By leveraging market loans to invest in these areas, businesses can gain a competitive advantage that can help them outperform their rivals and capture a larger share of the market.

Managing Risk and Securing Your Future

While market loans can provide businesses with a powerful tool for growth and innovation, it's important to approach them with caution. Businesses should carefully consider their financial situation and ensure that they have a solid plan for repaying the loan. They should also be aware of the potential risks associated with market loans and take steps to mitigate these risks, such as securing adequate collateral or working with a reputable lender.

In conclusion, market loans can be a powerful tool for businesses looking to grow, innovate, and secure a competitive edge. By understanding how market loans work and how they can be used effectively, businesses can unlock a world of opportunities that can lead to long-term success. With careful planning and a strategic approach, market loans can help businesses achieve their goals and secure their future in today's fast-paced business environment.