# Save Plan Loan Calculator: Your Ultimate Tool for Financial Freedom

## Introduction to the Save Plan Loan CalculatorIn today's fast-paced world, managing finances can often feel overwhelming. Whether you're planning to buy a……

## Introduction to the Save Plan Loan Calculator

In today's fast-paced world, managing finances can often feel overwhelming. Whether you're planning to buy a home, fund your education, or consolidate debt, having the right tools at your disposal is crucial. That's where the **Save Plan Loan Calculator** comes into play. This innovative tool is designed to help you make informed financial decisions, allowing you to save money and manage loans effectively.

## Understanding the Importance of a Loan Calculator

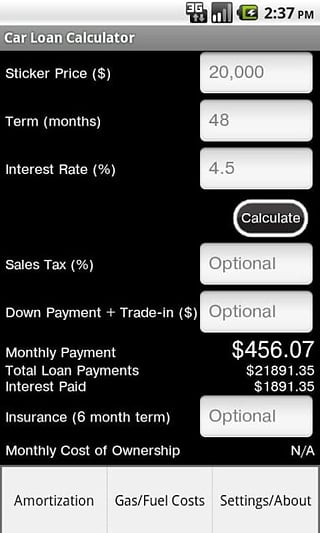

A loan calculator is an essential financial tool that helps you estimate your monthly payments, total interest, and overall loan costs. The **Save Plan Loan Calculator** simplifies this process, enabling you to visualize your financial future. By inputting various parameters such as loan amount, interest rate, and loan term, you can quickly see how different factors impact your payments.

## How the Save Plan Loan Calculator Works

Using the **Save Plan Loan Calculator** is straightforward. Here’s a step-by-step guide:

1. **Input Your Loan Details**: Enter the total loan amount you wish to borrow. This could be for a mortgage, car loan, or personal loan.

2. **Specify the Interest Rate**: Input the interest rate offered by your lender. This is crucial as it significantly affects your total repayment amount.

3. **Choose Your Loan Term**: Decide on the duration of the loan, typically ranging from a few months to several years.

4. **Calculate**: Hit the calculate button, and the **Save Plan Loan Calculator** will provide you with a detailed breakdown of your monthly payments, total interest paid, and the overall cost of the loan.

## Benefits of Using the Save Plan Loan Calculator

### 1. **Financial Clarity**

The **Save Plan Loan Calculator** offers clarity in your financial planning. By understanding how much you need to pay monthly, you can budget more effectively.

### 2. **Compare Loan Options**

With the calculator, you can easily compare different loan scenarios. For instance, by adjusting the interest rate or loan term, you can see how these changes affect your payments, helping you choose the best option.

### 3. **Save Money**

By using the **Save Plan Loan Calculator**, you can identify the most cost-effective loan options. This can lead to significant savings over the life of the loan, especially when it comes to interest payments.

### 4. **Empowerment in Decision-Making**

Having access to clear financial data empowers you to make informed decisions. Whether you’re negotiating with lenders or planning your budget, the insights gained from the calculator are invaluable.

## Conclusion: Take Control of Your Financial Future

In conclusion, the **Save Plan Loan Calculator** is an indispensable tool for anyone looking to manage their finances better. By providing clarity, enabling comparisons, and ultimately helping you save money, this calculator is your ally in achieving financial freedom. Don’t leave your financial future to chance; leverage the power of the **Save Plan Loan Calculator** today and take the first step towards a more secure financial future.

---

By incorporating the **Save Plan Loan Calculator** into your financial toolkit, you are not only gaining a powerful resource but also paving the way for smarter financial decisions. Start using it today and watch how it transforms your approach to loans and savings!