Understanding Chatel Loan: A Comprehensive Guide to Financing Your Personal Assets

Guide or Summary:Chatel Loan, translated as "chattel loan," refers to a type of financing that allows individuals to borrow money against personal property……

Guide or Summary:

#### What is Chatel Loan?

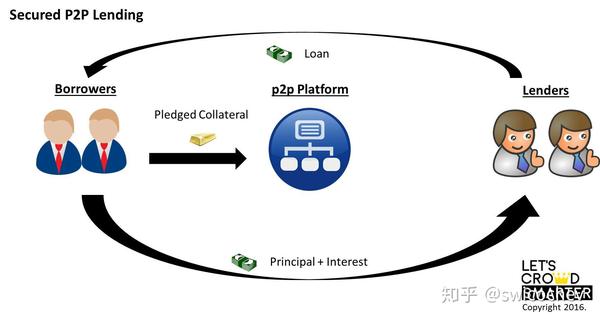

Chatel Loan, translated as "chattel loan," refers to a type of financing that allows individuals to borrow money against personal property or movable assets. This financial product is often used to acquire vehicles, equipment, or other valuable items that can be used as collateral. Unlike traditional loans that may require real estate as security, chatel loans focus on personal property, making them accessible to a broader range of borrowers.

#### How Does a Chatel Loan Work?

The process of obtaining a Chatel Loan is relatively straightforward. Borrowers typically need to provide documentation proving ownership of the asset they wish to use as collateral. This may include titles, registration papers, or receipts. Lenders will assess the value of the asset and determine the loan amount based on a percentage of that value, often ranging from 50% to 80%.

Once the loan is approved, borrowers receive the funds, which can be used for various purposes, such as purchasing new equipment, consolidating debt, or funding personal projects. The borrower will then repay the loan over a specified term, usually with fixed monthly payments. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover their losses.

#### Benefits of a Chatel Loan

There are several advantages to choosing a Chatel Loan over other financing options.

1. **Accessibility**: Since chatel loans are secured by personal property, they can be more accessible to individuals with less-than-perfect credit. Lenders may be more willing to approve loans when there is collateral involved.

2. **Quick Approval**: The approval process for a chatel loan can be quicker than that of traditional loans, as the lender has a tangible asset to secure the loan.

3. **Flexible Use of Funds**: Borrowers can use the funds from a chatel loan for a variety of purposes, providing flexibility in how they manage their finances.

4. **Lower Interest Rates**: Because chatel loans are secured by collateral, they often come with lower interest rates compared to unsecured loans, making them a cost-effective option for borrowing.

#### Considerations Before Taking a Chatel Loan

While there are many benefits to Chatel Loans, potential borrowers should also consider a few important factors before proceeding:

1. **Risk of Asset Loss**: If the borrower fails to repay the loan, they risk losing the asset used as collateral. This is a significant consideration for anyone thinking about taking out a chatel loan.

2. **Loan Terms**: It's crucial to understand the terms of the loan, including interest rates, repayment schedules, and any fees associated with the loan. Borrowers should shop around to find the best deal.

3. **Asset Depreciation**: The value of the asset used as collateral may depreciate over time, which could impact the loan-to-value ratio and the lender's willingness to extend credit.

4. **Regulatory Considerations**: Depending on the jurisdiction, there may be specific regulations governing chatel loans. Borrowers should ensure they understand the legal implications of taking out this type of loan.

#### Conclusion

In summary, a Chatel Loan can be a valuable financial tool for individuals looking to leverage their personal assets for borrowing. With quick approval processes, lower interest rates, and flexible use of funds, chatel loans offer a viable alternative to traditional financing methods. However, it's essential for borrowers to weigh the benefits against the risks and ensure they fully understand the terms of the loan before proceeding. By doing so, they can make informed financial decisions that align with their goals and circumstances.