Understanding Advance America Personal Loan: Your Guide to Quick Financial Relief

Guide or Summary:What is Advance America Personal Loan?How Does Advance America Personal Loan Work?Benefits of Advance America Personal LoanConsiderations B……

Guide or Summary:

- What is Advance America Personal Loan?

- How Does Advance America Personal Loan Work?

- Benefits of Advance America Personal Loan

- Considerations Before Applying

When it comes to managing unexpected expenses or consolidating debt, many individuals turn to personal loans for assistance. One popular option in the market is the **Advance America Personal Loan**. This financial product is designed to provide quick access to cash, making it an appealing choice for those in need of immediate funds.

What is Advance America Personal Loan?

The **Advance America Personal Loan** is a type of unsecured loan offered by Advance America, a well-known provider of financial services. Unlike secured loans, which require collateral, personal loans do not necessitate any asset to back the loan. This feature makes them accessible to a wider range of borrowers who may not have valuable property to pledge.

How Does Advance America Personal Loan Work?

Applying for an **Advance America Personal Loan** is a straightforward process. Borrowers can typically complete the application online or in-store, providing essential information such as income, employment status, and the desired loan amount. Once approved, funds are often disbursed quickly, sometimes on the same day. This speed is one of the primary attractions of personal loans, especially for those facing urgent financial situations.

Benefits of Advance America Personal Loan

1. **Quick Access to Funds**: One of the most significant advantages of the **Advance America Personal Loan** is the rapid access to cash. Borrowers can receive funds within a short period, allowing them to address emergencies or seize opportunities without delay.

2. **Flexible Loan Amounts**: Advance America offers various loan amounts, catering to different financial needs. Whether you require a small sum for a minor expense or a larger amount for significant financial obligations, there are options available.

3. **No Collateral Required**: Since these loans are unsecured, borrowers do not need to risk their assets. This feature makes personal loans a safer option for many individuals.

4. **Easy Application Process**: The application process for an **Advance America Personal Loan** is designed to be user-friendly. With options to apply online or in person, borrowers can choose the method that best suits their needs.

Considerations Before Applying

While the **Advance America Personal Loan** offers several benefits, it’s essential to consider a few factors before applying:

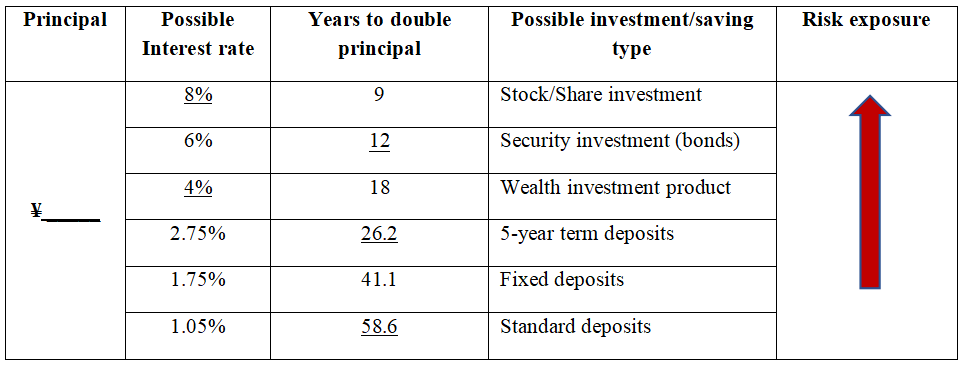

1. **Interest Rates**: Personal loans can come with higher interest rates compared to traditional bank loans. Borrowers should review the terms and ensure they understand the total cost of borrowing.

2. **Repayment Terms**: Understanding the repayment schedule is crucial. Borrowers should ensure they can meet the monthly payment obligations without straining their budget.

3. **Credit Score Impact**: Applying for a personal loan can affect your credit score. It’s advisable to check your credit report and ensure you are in a good position before applying.

The **Advance America Personal Loan** can be a valuable financial tool for those in need of quick cash. With its straightforward application process and rapid fund disbursement, it offers a convenient solution for various financial challenges. However, potential borrowers should carefully assess their financial situation, consider the terms of the loan, and ensure they can meet repayment obligations. By doing so, they can make an informed decision and use the personal loan to their advantage.