Understanding the Credit Score Needed for House Loan Approval: A Comprehensive Guide

#### What is a Credit Score?A credit score is a numerical representation of an individual's creditworthiness, which lenders use to evaluate the risk of lend……

#### What is a Credit Score?

A credit score is a numerical representation of an individual's creditworthiness, which lenders use to evaluate the risk of lending money or extending credit. Typically ranging from 300 to 850, a higher score indicates better creditworthiness. Various factors contribute to your credit score, including payment history, credit utilization, length of credit history, types of credit in use, and recent inquiries.

#### Why is a Credit Score Important for House Loans?

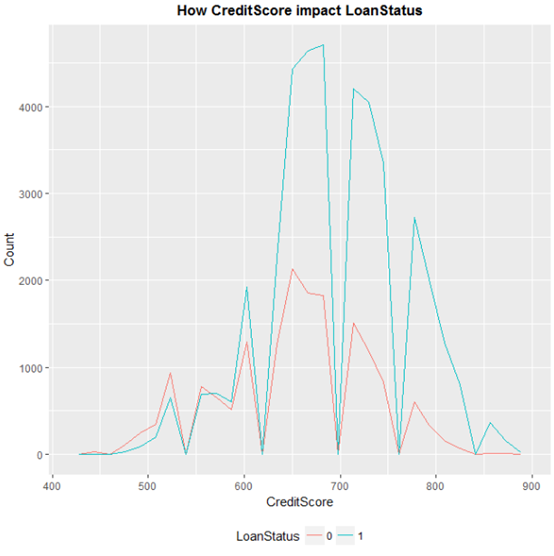

When it comes to obtaining a house loan, your credit score plays a crucial role. Lenders use this score to determine not only whether you qualify for a mortgage but also what interest rates you will receive. A higher credit score can lead to lower interest rates, which can save you thousands of dollars over the life of the loan. Conversely, a lower credit score may result in higher interest rates or even denial of the loan application.

#### Credit Score Needed for House Loan: What You Should Aim For

Generally, the credit score needed for a house loan varies by lender and loan type. However, most conventional loans require a minimum credit score of around 620. FHA loans, which are backed by the Federal Housing Administration, may allow for lower scores, sometimes as low as 580, provided you can make a larger down payment. VA loans, available to veterans and active-duty service members, typically do not have a minimum credit score requirement but may still consider your credit history.

#### Improving Your Credit Score Before Applying for a House Loan

If your credit score is below the desired threshold, there are steps you can take to improve it before applying for a house loan. Here are some tips:

1. **Pay Your Bills on Time**: Your payment history is one of the most significant factors affecting your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

2. **Reduce Your Credit Utilization Ratio**: Aim to keep your credit utilization below 30%. This means if you have a total credit limit of $10,000, you should not carry a balance higher than $3,000.

3. **Avoid New Credit Applications**: Each time you apply for new credit, a hard inquiry is made on your report, which can temporarily lower your score. Avoid applying for new credit in the months leading up to your mortgage application.

4. **Check Your Credit Report for Errors**: Regularly review your credit report for any inaccuracies or fraudulent accounts. Disputing errors can help improve your score.

5. **Build a Diverse Credit Portfolio**: Having a mix of credit types—such as revolving credit (credit cards) and installment loans (car loans, personal loans)—can positively impact your score.

#### Conclusion: Preparing for Your Home Loan Application

Understanding the credit score needed for a house loan is essential for anyone looking to buy a home. By aiming for a score of at least 620 and taking proactive steps to improve your credit, you can enhance your chances of loan approval and secure a favorable interest rate. Remember that preparing for a mortgage involves more than just having a good credit score; it also requires a stable income, a reasonable debt-to-income ratio, and a solid savings plan for your down payment. By being informed and prepared, you can navigate the home-buying process with confidence.